Small Business and Personal Accountants in Vancouver

10-Year Tax Review for

Trades Business Owners!

Discover if you've missed out on valuable tax refunds.

Our 100-point checklist ensures your past tax filings have maximized your returns. Sign up today—no obligations. You'll either get expert advice for future tax savings or claim a refund you didn’t know you were entitled to.

Over 52% of Canadians we've helped were owed more than they thought!

Don’t take our word for it ..

How It Works

15-min Consult

Start with a 15-minute phone call and tell us about your tax history over the past 10 years.

Comprehensive Analysis

We will thoroughly analyze your tax records and identify any potential refunds that may have been missed in the last decade.

Bonus Offer!

Sign up before November 30 to receive a customized set of recommendations to help you save on taxes moving forward, tailored specifically to your financial situation.

Complete

If you are eligible for a refund, you will be notified with all the necessary details and steps to claim it.

Why Choose Us?

More Than Just Tax Filing—Your Partner in Financial Growth

At Growth Accountants, we do more than just file your taxes. Our focus is on proactive planning and finding opportunities to save you money and help you grow financially. Unlike traditional tax services, we dive deep into your financial history to uncover savings and create strategies tailored to your needs.

10-Year Tax Review

Through our 10-Year Tax Review, we get to know your financial patterns in detail. This lets us offer personalized advice that goes beyond a one-time tax session. Most clients who start with this review stay with us for ongoing tax planning and preparation because they see the value in our comprehensive approach.

Planning for Your Future

We focus on what you can control—your future. By planning ahead, we help you make smarter financial choices and optimize your tax outcomes for years to come.

Our Certifications

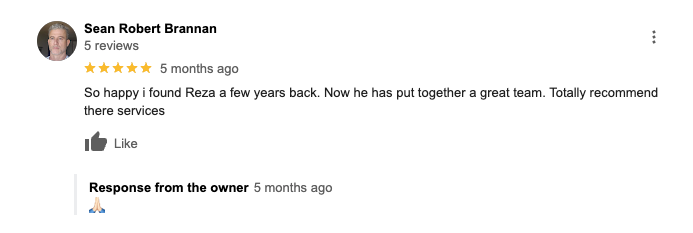

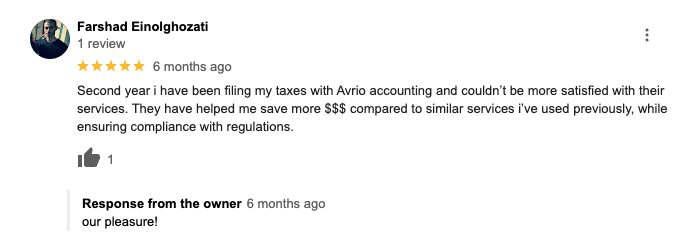

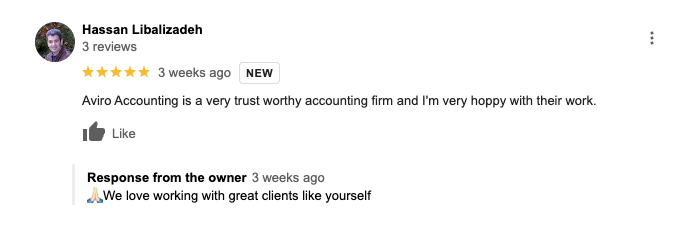

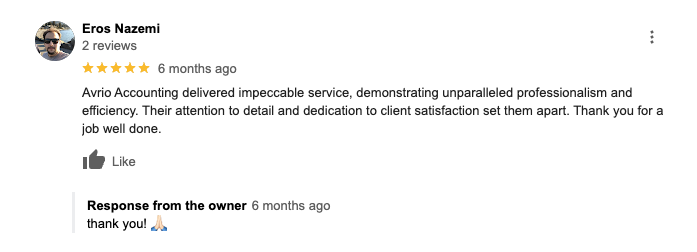

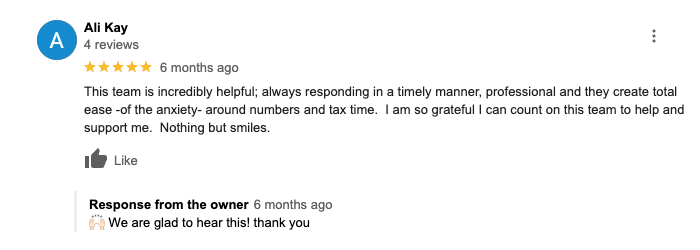

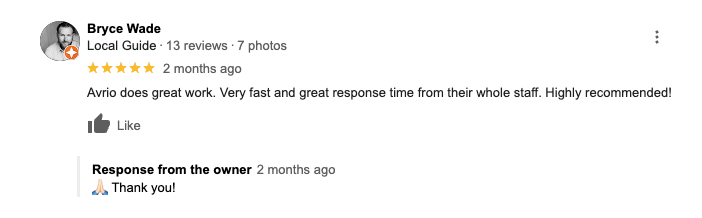

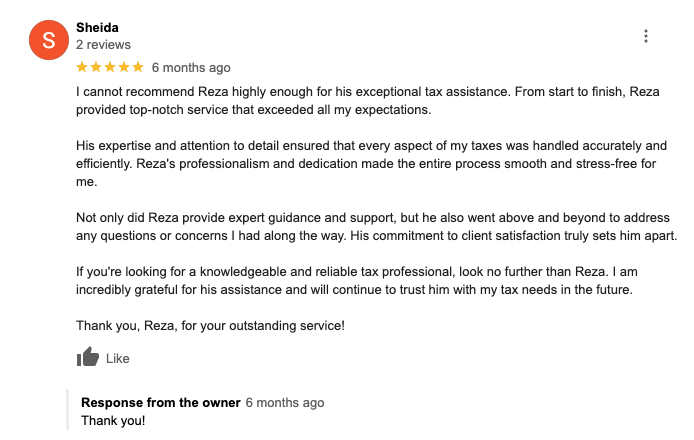

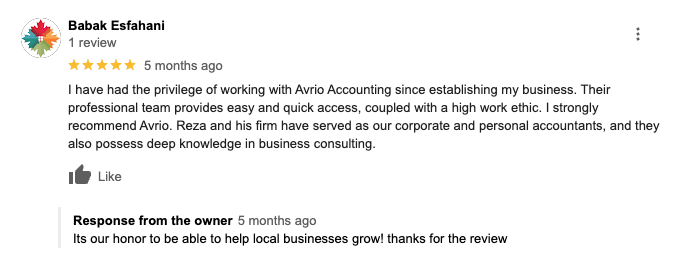

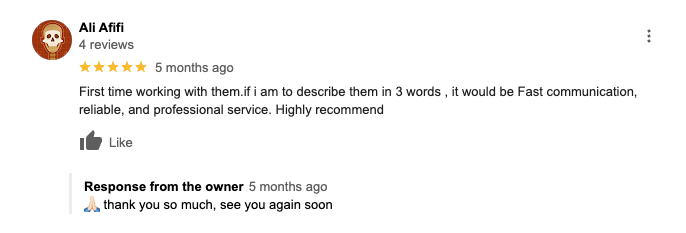

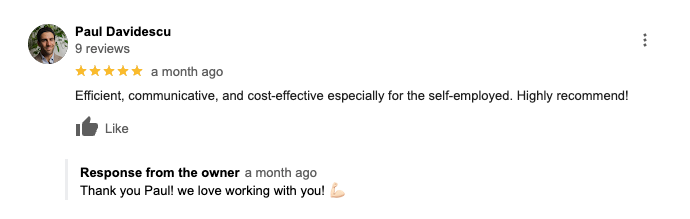

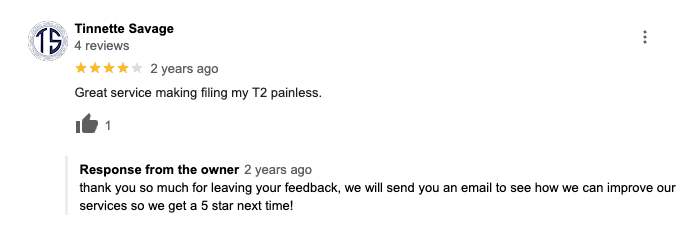

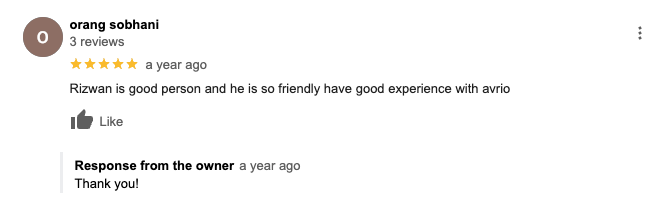

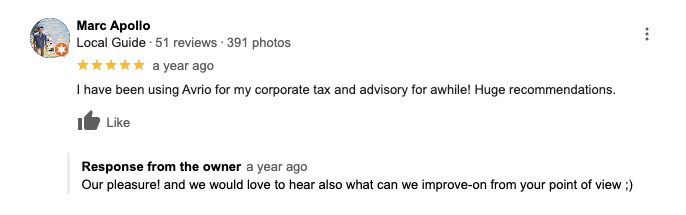

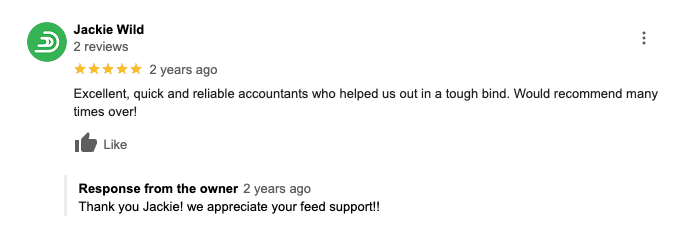

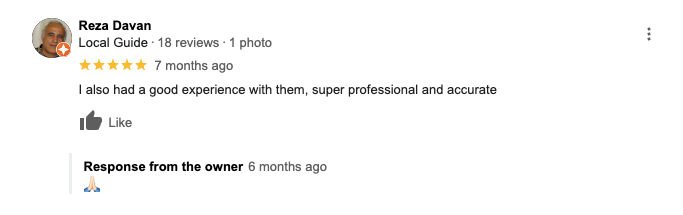

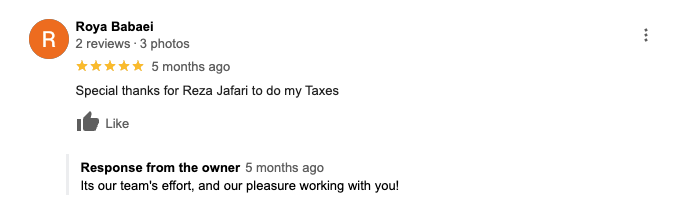

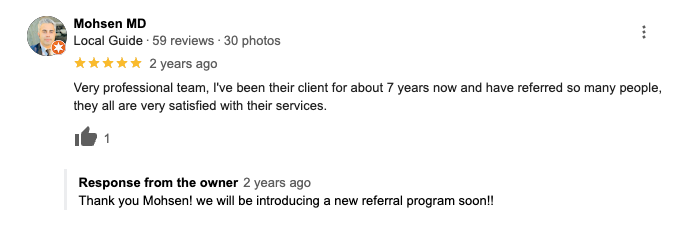

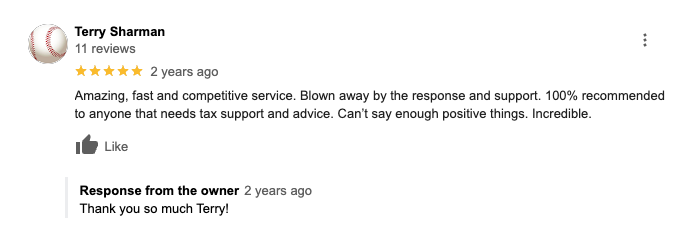

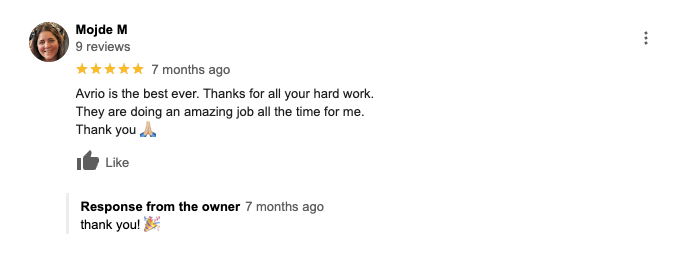

Reviews

Commonly Asked Questions

-

Nothing at all. We handle everything online. During our initial call, we’ll ask for your permission to temporarily access your CRA account as a registered agent. From there, we take care of the rest. You can always monitor our activities by logging into your MyCRA account.

-

The entire process typically takes less than 3 weeks. However, due to high demand, it might take a bit longer. Throughout the process, you’ll have direct contact with an advisor who can answer any questions or address concerns you may have.

-

Yes! We generally submit adjustments for refunds that are more than $500. In fact, we find refunds for about 70% of the people who go through our review.

-

No, undergoing a 10-Year Tax Review does not trigger an audit. When we submit an adjustment, the CRA may request additional documents for the specific year being reviewed, but this is standard.

-

No, your account won’t be flagged. Adjustments are common, with millions of Canadians making changes for various reasons every year. When we identify a refund opportunity, we collect the necessary documents and submit adjustments carefully. This way, if CRA requests documentation, we’re fully prepared, increasing the likelihood of your approval.